State Wireless Taxes Compared

October 12, 2014/

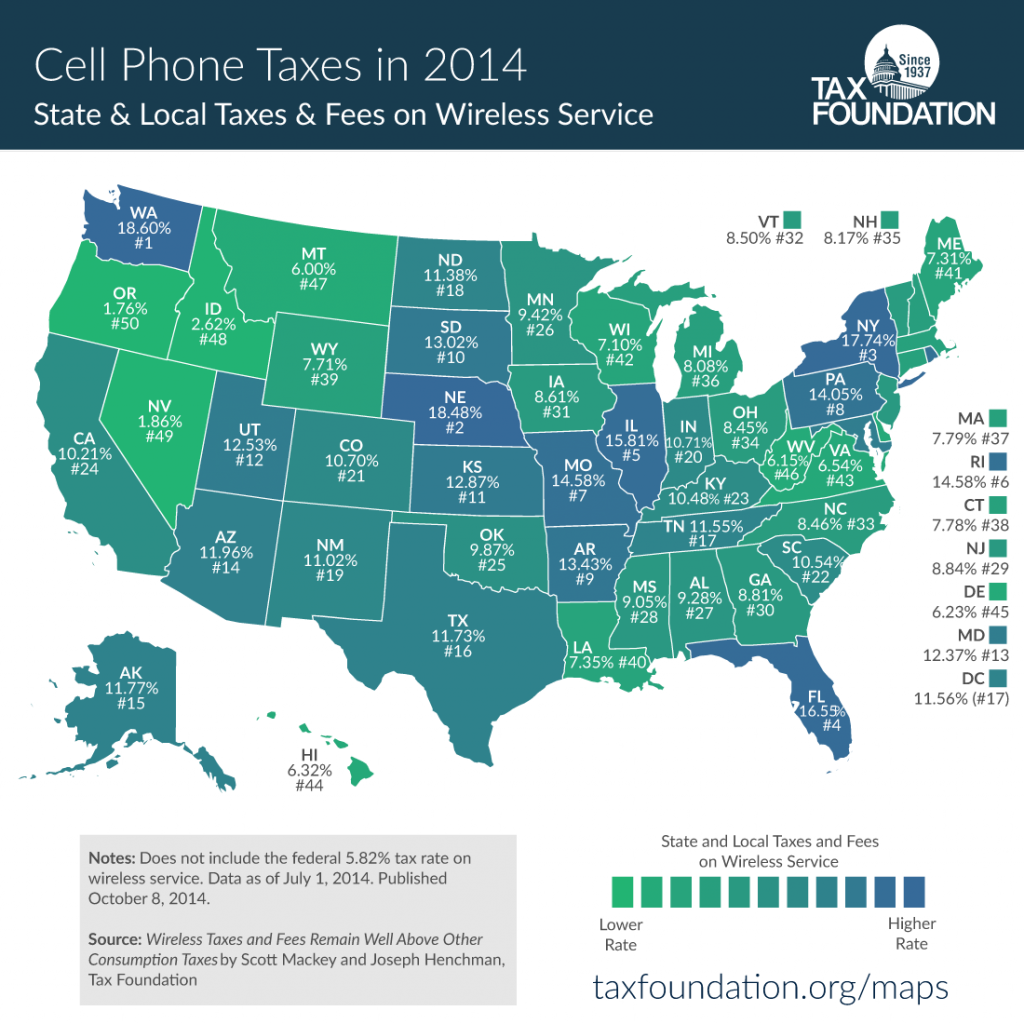

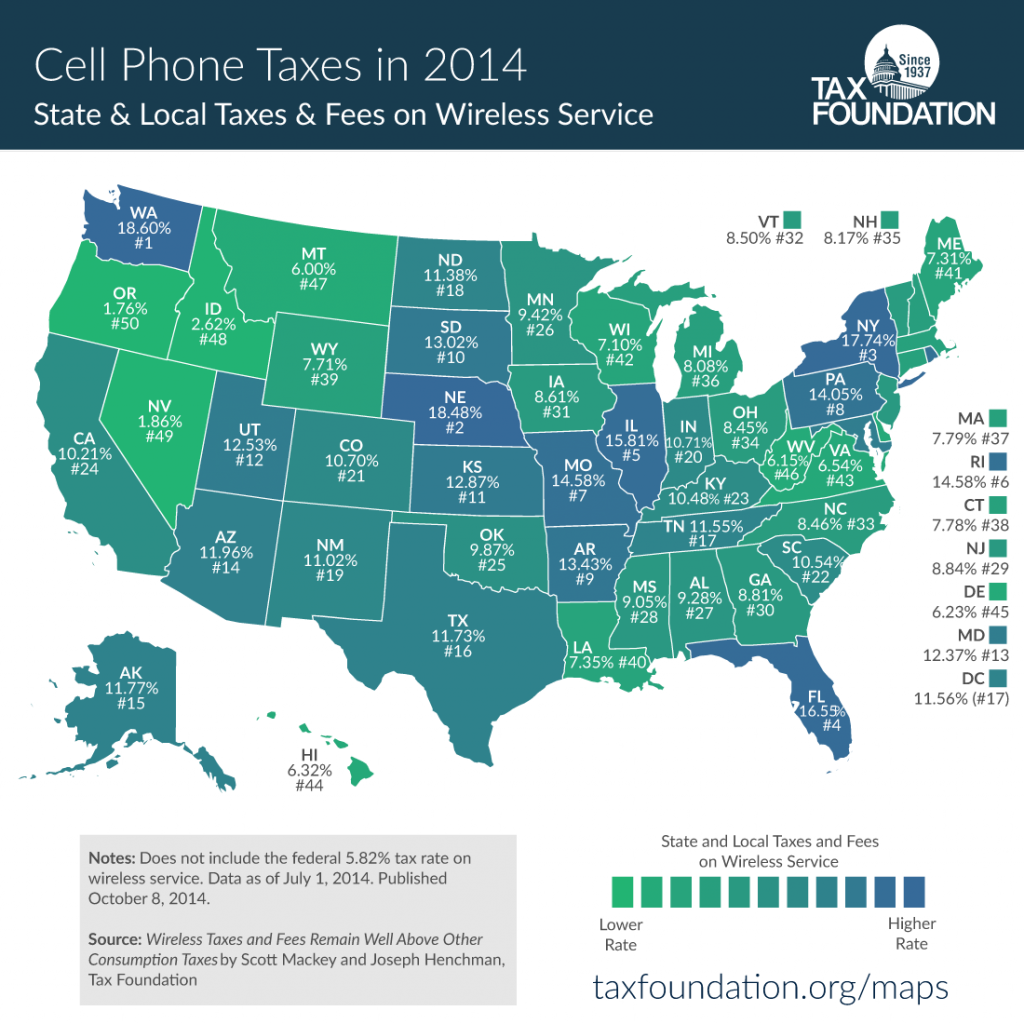

Taxes on wireless transactions are a pain for prepaid and postpaid customers alike. But have you ever wondered how your state compares to others as far as tax goes?

Yeah, me neither. It’s not something I ever really thought about until I saw this report. The Tax Foundation did as study comparing this year’s wireless state and local taxes, and some of the figures were a little surprising. While these tax rates are mostly relevant for postpaid, prepaid customers still pay a percentage of these taxes so I thought I might take a sec and share.

To start, these are the top five states with the highest state-local wireless tax:

If you want to take a look at the report yourself, you can read it here. Consider yourself warned, it’s honestly a little boring to read through but some of the facts and figures are a little startling. For example, in four cities–Chicago, Baltimore, Omaha and New York City–the effective tax rates for wireless bills is more than 25% of the actual cost of the bill. I simply can’t even fathom paying that much additional on every bill and my state is in the top 10.

So, where does your state rank? Let me know in the comments!]]>

If you want to take a look at the report yourself, you can read it here. Consider yourself warned, it’s honestly a little boring to read through but some of the facts and figures are a little startling. For example, in four cities–Chicago, Baltimore, Omaha and New York City–the effective tax rates for wireless bills is more than 25% of the actual cost of the bill. I simply can’t even fathom paying that much additional on every bill and my state is in the top 10.

So, where does your state rank? Let me know in the comments!]]>

- Washington State (18.6%)

- Nebraska (18.48%)

- New York (17.74%)

- Florida (16.55%)

- Illinios (15.81%)

- Oregon (1.76%)

- Nevada (1.86%)

- Idaho (2.62%)

- Montana (6%)

- West Virginia (6.15%)

If you want to take a look at the report yourself, you can read it here. Consider yourself warned, it’s honestly a little boring to read through but some of the facts and figures are a little startling. For example, in four cities–Chicago, Baltimore, Omaha and New York City–the effective tax rates for wireless bills is more than 25% of the actual cost of the bill. I simply can’t even fathom paying that much additional on every bill and my state is in the top 10.

So, where does your state rank? Let me know in the comments!]]>

If you want to take a look at the report yourself, you can read it here. Consider yourself warned, it’s honestly a little boring to read through but some of the facts and figures are a little startling. For example, in four cities–Chicago, Baltimore, Omaha and New York City–the effective tax rates for wireless bills is more than 25% of the actual cost of the bill. I simply can’t even fathom paying that much additional on every bill and my state is in the top 10.

So, where does your state rank? Let me know in the comments!]]>

Posted in News

WA state is where I am! 20 minutes from the Oregon border 🙂 Seriously though, those are postpaid tax rates though. That is why I am prepaid!

Agreed, prepaid is so cheaper! Although some prepaid companies and plans do still charge a percentage of those taxes, I believe. Don’t ask me which or how much, but I know that some do.